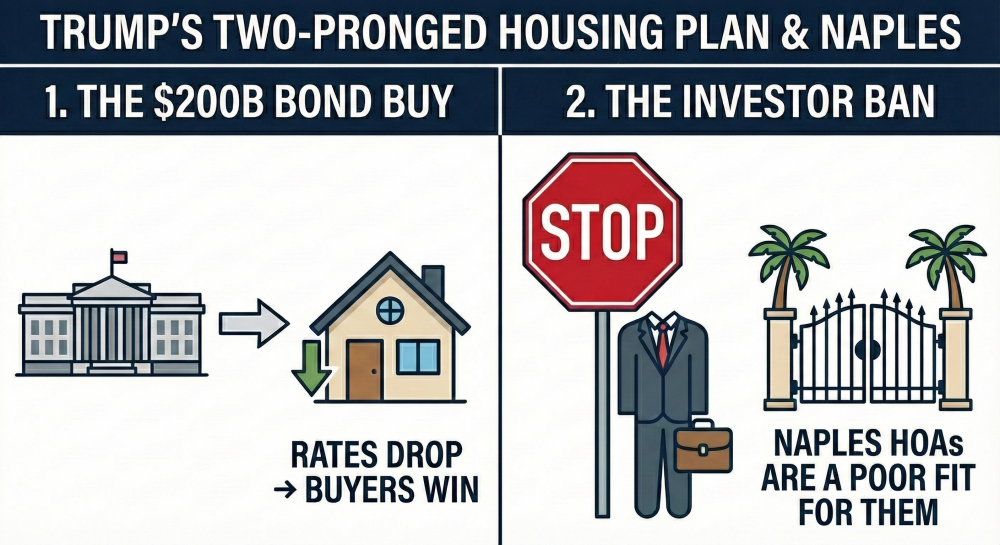

So, you've probably seen the big news this week: The government is shaking things up with a huge two-part plan for the housing market. As we jump into the 2026 spring market, here's what it actually means for folks buying and selling down here in Naples.

1. The $200 Billion 'Rate Perk' The President told Fannie Mae and Freddie Mac to buy up $200 billion in mortgage bonds. It hasn't kicked off yet, but the effect might be quick and then fade.

-

How it Works: This artificially boosts the demand for mortgage bonds, which pushes down bond yields and, in turn, mortgage rates. Think of it like the "Quantitative Easing" the Federal Reserve did after the 2008 crash.

-

The Early Vibe: We saw an instant reaction Friday, with rates already sliding back into the high 5% range just on the possibility of this happening.

-

Bottom Line: If you’ve been waiting for rates to drop, this could be your moment. But treat it as a quick shot of adrenaline, not a new normal.

2. Banning 'Wall Street' Buyers: No Biggie for Naples? The second plan is to stop those massive corporate investors (like hedge funds) from snapping up single-family homes. That's huge for places like Atlanta or Phoenix, but for Naples? Probably a non-issue.

-

Corporate Landlord Rules: These big landlords have a very strict checklist for what they buy. They're looking for maximum profit with minimum headache.

-

The HOA Problem: Down here in Southwest Florida, our common HOA and Condo fees are a natural buzzkill for these funds (those fees eat their profits). Plus, our tough association rules about renting out properties are usually way too much hassle for their business model.

-

Local Take: Since institutional buyers mostly skip our gated, high-fee communities anyway, banning them isn't going to suddenly make a ton of homes available in Naples. We’re just not their target.

What's the Deal for You? This is a national 'policy pivot' meant to free up homes and lower costs across the country, but real estate is always local.

-

Buyers: Seriously, focus on the rate drop. That’s the real, immediate win for you.

-

Sellers: Don't stress that the 'investor ban' will hurt your home's value. If you're in a deed-restricted community, 'Wall Street' wasn't looking at your house in the first place.

This market moves fast—let's chat about how these changes affect your specific property!